Departments created within an account can have separate settings. It is possible to set a different invoice template, company logo, or document numbering. The Company/department settings always take priority over the general account settings. Within a department, you can also set a default tax rate that differs from the rates used by other departments/companies. This article will guide you on where to set the default tax rate for documents issued within a specific department.

Default tax rate on a department’s documents

To set the default tax rate for a department:

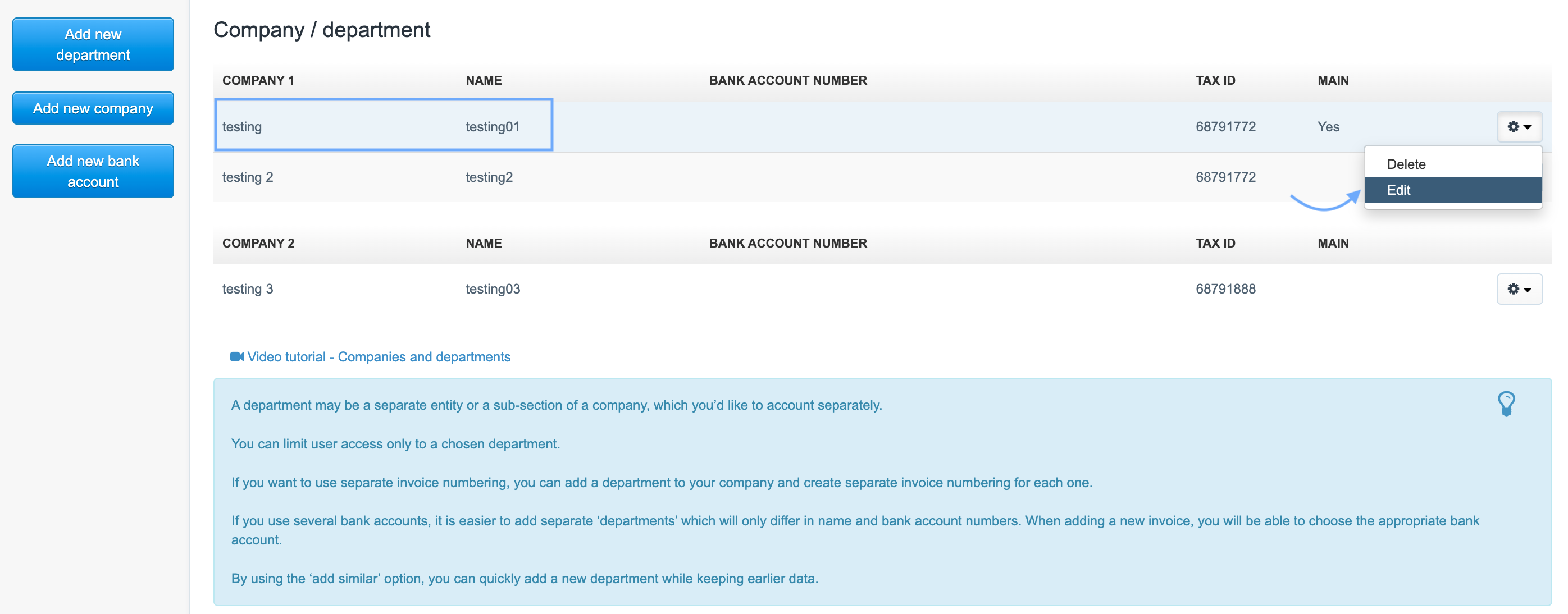

1. Go to Settings > Company/department tab.

2. In the list of departments, click on the name of the department you want to edit, or click the gear icon and select Edit; the system will take you to the edit form.

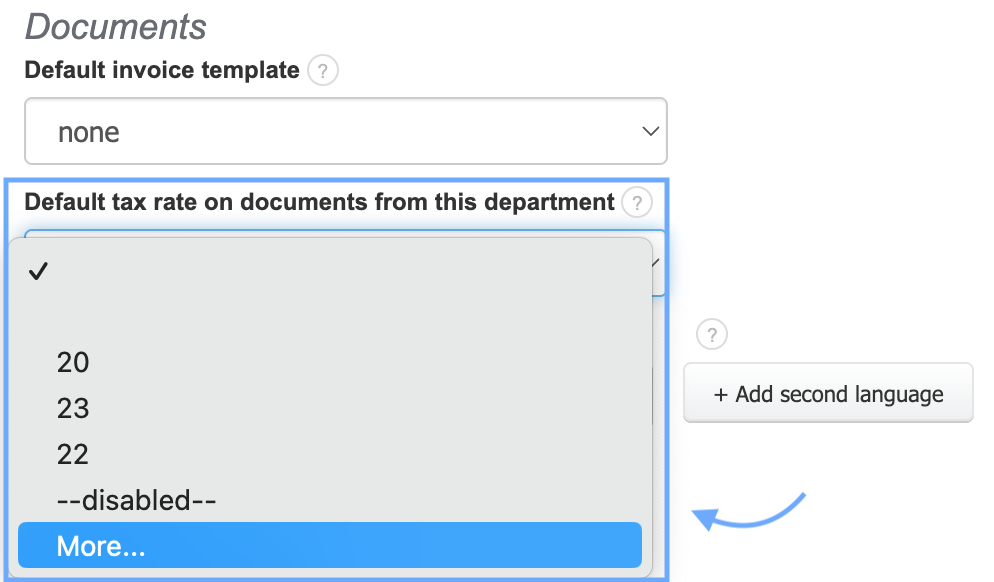

3. Scroll down in the form to go to the Documents section.

4. In the Default tax rate on documents from this department field, you can choose one of the available rates or add your own using the More option.

Confirm the changes by clicking the Save button at the bottom of the page.

When issuing documents for a department that has a default tax rate specified, the system will automatically fill it in on the document creation form.